The Debt Collective: $600 Million in Debt Discharge

By: Hannah Appel, University of California, Los Angeles; Laura Hanna, Debt Collective; Ann Larson, Debt Collective; Latonya Suggs, Debt Collective

The Debt Collective is organized around the possibility of radical action against finance capitalism. In the age of finance, debt has become a systemic problem—from the mortgage crisis to student debt, criminal “justice” fines and fees to municipal austerity. But debt is a problem that, in its ubiquity, may hold the seeds of its own solutions.

As of spring 2017, our pilot union—the Corinthian Collective—has secured meaningful, if partial victories. The strikers have won $600 million in debt discharge, and the Debt Collective’s Defense to Repayment Tool has be used to file 82,000 legal claims. Citing the work of the Debt Collective and others, the M4BL policy platform includes full debt discharge and free higher education as the first demand of their reparations plank, and even in popular culture, there is good reason to believe our strike has changed the terrain of possibility:

The Debt Collective’s pilot union members joined around one specific injustice: exploitative debt from for profit colleges. But the financialization of higher education is just a symptom of structural problems with privatization and racial capitalism. To address these structural problems and offer our members tools to move from specific injustices to the systemic fight, The Debt Collective has begun to work with our members, editors, writers and publishers on The Popular Education Initiative, which translates arguments for public provision—a federal job guarantee; universal healthcare; tuition free education; baby bonds; anti-austerity federal spending—into everyday language. Debt Collective members will use The Popular Education Initiative as outreach materials to share in their communities.

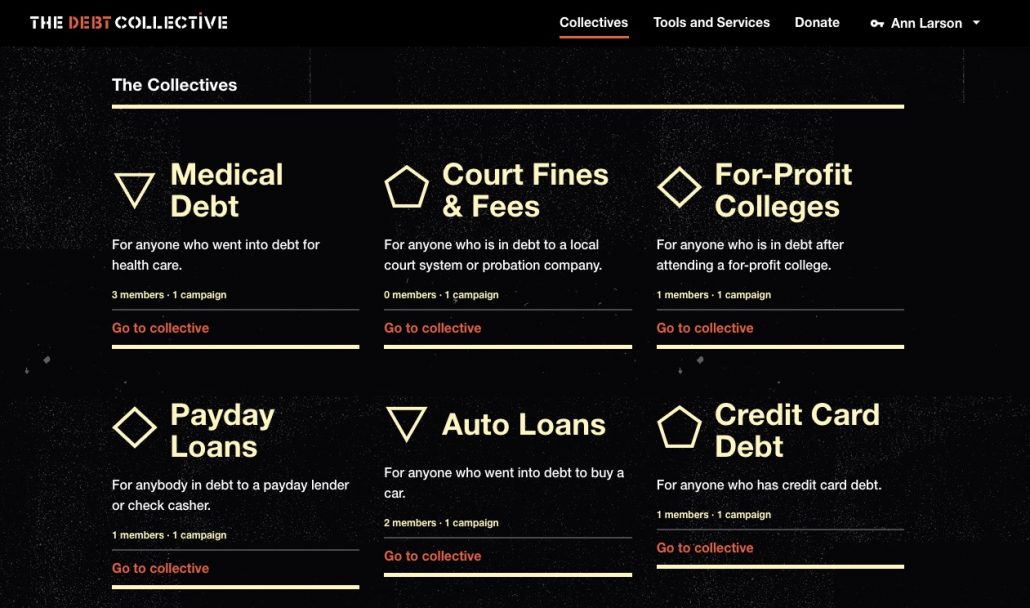

This means that The Debt Collective is not simply renegotiating debt but also forcing open questions that the era of finance seems to have foreclosed: how do we even pay for things that matter—education, healthcare, housing—in the first place? The Popular Education Initiative articulates a vision for public provision, and debtors’ unions provide the collective power to realize those demands. Our new online platform to be released in late Spring 2017, enables union organizing to proliferate beyond for-profit colleges to unions for payday loans, mortgage debt, criminal justice fines and fees, and beyond.